April is usually a busy time for employment law updates, and this year is no different. With so many incoming changes, you’d be forgiven for not keeping track of them all!

Luckily, I’ve done all the hard work for you; you don’t need to move a muscle! I’ve pulled together a complete guide of the significant employment law developments that could affect you, your business, and your employees.

So, grab a cuppa, and let’s jump right in…

Rise in the National Minimum and Living Wage – 1st April 2021

This Thursday, the National Living Wage (NLW) will increase by 2.2%. Historically, it has applied to workers over 25, but for the first time it will be extended to those aged 23 and 24. This means that individuals in this age bracket will see their salaries increase by nearly 9%.

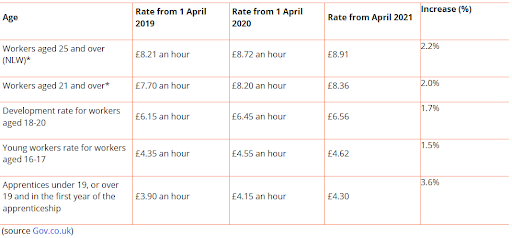

The national minimum wage (NMW) applies to all workers and is paid at different rates according to age. The current and future rates for the minimum wage (which represents gross pay) are as follows:

*From 2021, the NLW will be extended to cover all adults aged 23 and above.

Gender Pay Gap Reports – 4th April 2021

Private and voluntary sector employers in England, Wales and Scotland with at least 250 employees are required to publish information about the differences in pay and bonuses between men and women in their workforce. This will be based on a ‘snapshot’ date on 5th April each year.

COVID-19

In view of the unprecedented pressures on businesses caused by the pandemic, the government announced a suspension of enforcement measures on gender pay gap reporting for 2019/20. Employers now have until 5th October 2021 to report their 2020/21 figures before enforcement measures are taken. All businesses are encouraged to report by the usual reporting deadlines.

Extension of IR35 to the private sector & engaging contractors (applicable to medium to large businesses) – 6th April 2021

The IR35 rules prevent contractors who are performing similar roles to employees and are working through Personal Service Companies (PSCs), from paying less tax and National Insurance Contributions (NICs) than if they were permanently employed by the client organisation.

In April 2017, responsibility for deciding whether contractors working in the public sector were caught by IR35 switched from the contractor to their end users. They also became liable for deducting the right amount of tax and NICs.

From 6th April 2021, deciding whether IR35 applies becomes the responsibility of all private sector employers that have, in a tax year:

- more than 50 employees

- an annual turnover over £10.2 million

- a balance sheet worth over £5.1 million.

HMRC has published guidance on the new rules available at www.gov.co.uk

Increase in rates for family friendly payments – 4th April 2021

The rates of Statutory Maternity Pay, Statutory Paternity Pay, Statutory Adoption Pay, Statutory Shared Parental Pay and Statutory Parental Bereavement Pay will increase from £151.20 to £151.97 (or 90% of an employee’s average weekly earnings, whichever is lower).

Statutory sick pay – 4 April 2021

The standard rate of Statutory Sick Pay (SSP) will also increase to £96.35 per week.

Employment Tribunal Awards – 6th April 2021

The annual increase to the compensation limits on certain employment tribunal awards and to statutory payments will come into effect on 6th April 2021.

Limits on tribunal awards will increase as follows:

- The cap on a week’s pay (used to calculate the basic awards in unfair dismissal cases and statutory redundancy payments) will increase to £544 (from £538)

- The maximum compensatory award for ordinary unfair dismissal will increase to £89,493 (from £88,519)

- The minimum basic award for certain unfair dismissals (including dismissals for reasons of trade union membership or activities, health and safety duties, pension scheme trustee duties, or acting as an employee representative or workforce representative) will increase to £6,634 (from £6,562).

The new figures will apply where the effective date of termination in dismissal cases and the relevant date for redundancy payments falls on or after 6th April 2021.

Statutory redundancy payments will need to be recalculated in line with the increased limits for any redundancies taking effect on or after this date.

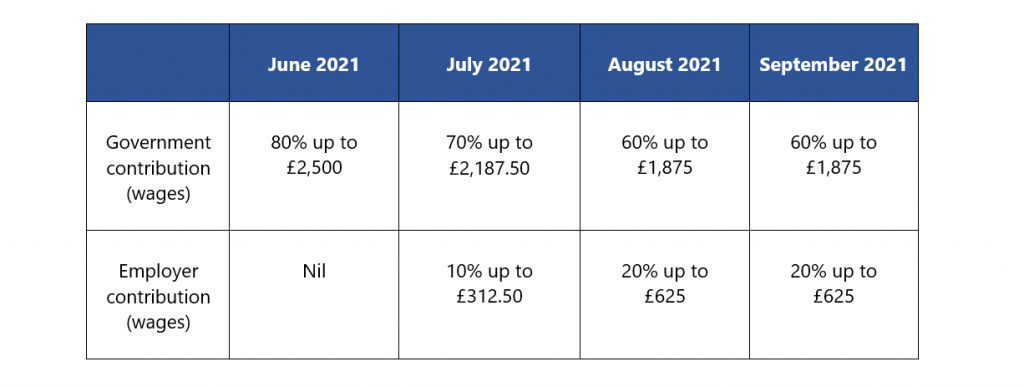

Changes to the Coronavirus Job Retention Scheme (CJRS) scheme – 1st August

Employers are to contribute wages to the CJRS. The table below shows a monthly breakdown of all furlough contributions with the scheme expected to end on the 30th September 2021;

Future Updates under consultation

Here are some further changes to look out for that are still under consultation. They haven’t been given firm dates on when they’ll become law, but they’re certainly worth having on your radar:

- Allocation of Tips

Initially announced in October 2019, this would require employers to pass on all tips and service charges to their workers. It would also require any tip distribution by employers to be undertaken on a fair and transparent basis. - Leave for Unpaid Carers

The government has also announced a proposal to extend leave entitlement for unpaid carers (who the party recognised are mostly women). The forthcoming bill is expected to include a provision for an entitlement to one week’s leave. - Extension to Redundancy Protections to Pregnant Workers

At present, the law states that before making a woman on maternity leave redundant, an employer must offer her a suitable alternative vacancy where one is available.

However, the government is looking to extend this protection so that it applies from the date an employee notifies the employer in writing of her pregnancy, to six months after her return from maternity leave. - Extended leave for neonatal care

In March 2020, the government announced that it would create a new statutory entitlement to neonatal leave and pay for employees whose babies spend an extended period of time in neonatal care, providing up to 12 weeks’ paid leave. - Flexible working

The government has announced it intends to introduce legislation making flexible working the default position, unless an employer provides good reason not to.

All of these changes are expected to be included in the forthcoming Employment Bill. - Exclusivity clauses

The Government has launched a consultation on extending the ban on exclusivity clauses in employment contracts to prevent employers from restricting low-paid employees (i.e. those earning below £120 per week) from working for another employer.

Landmark cases & rulings

Over the past few months, there have been 2 high profile employment tribunal cases with landmark ruling:

1. Care workers who ‘sleep-in’ are not entitled to national minimum wage

Royal Mencap Society v Tomlinson-Blake and Shannon v Rampersad

Care workers who sleep at service users’ homes are not entitled to the National Minimum Wage (NMW) for the hours they are not carrying out work activities, the Supreme Court has ruled.

This landmark decision is set to have ramifications for jobs where workers are required to sleep at their place of work.

It was found that a worker is only entitled to the NMW for the hours they are awake and working, and the time a worker is required to sleep on site or nearby does not count towards their minimum wage calculations.

While the legal certainty surrounding sleep-in payments will be welcomed by those operating in the care sector, it still leaves some difficult issues to consider:

- Will commissioners currently paying for sleep-ins continue to do so?

- Should care providers who are paying for sleep-ins stop?

This may give rise to future employee relation problems and employment tribunal claims will be forced to provide some clarity on this soon.

You can read further at: affinityhrm.co.uk/supreme-court-rules-care-companies-do-not-have-to-pay-sleep-shifts

Uber Drivers ARE Workers

The UK Supreme Court has declared that Uber must treat their drivers as workers as opposed to self-employed individuals.

This decision comes after Uber appealed a ruling by an employment tribunal in 2016 which sided with the drivers, classing them as workers.

This means that drivers will be entitled to key rights under their new employment status such as: minimum wage, rest breaks, and holiday pay.

Prior to this, drivers were classified as self-employed, leaving drivers with minimum protections at work.

This landmark case could have further implications for the wider gig economy.

You can read about this further and what this means for many businesses here: affinityhrm.co.uk/ubers-employment-status-case-has-been-published

Vaccine rollout

The vaccine rollout is well underway. Over the past month, we’ve been asked a number of workplace, vaccine related questions, which have been difficult to answer in the absence of any government guidance.

There’s also been much speculation over whether employers can require their employees to have the COVID-19 vaccine, or if they could restrict them from coming into a place of work without the jab.

Thankfully, CIPD and Acas have now released new workplace guidance to help employers support and educate their staff to get the vaccine, while maintaining good workplace relations, and avoiding unnecessary conflict.

It is recommended that employers should support staff in getting the COVID-19 vaccine once it’s offered to them. You may find it useful to talk with your staff about the vaccine and its benefits (specific guidance can be found at gov.uk).

Acas

To encourage staff to get the vaccine, Acas have suggested employers might consider:

- Paid time off to attend vaccination appointments

- Paying staff their usual rate of pay if they’re off sick with vaccine side effects, instead of Statutory Sick Pay (SSP)

not counting vaccine-related absences in absence records or towards HR ‘trigger’ points

In short, their advice is to support staff to get the vaccine without making it a requirement.

Find their guidance in full, here: www.acas.org.uk/working-safely-coronavirus/getting-the-coronavirus-vaccine-for-work

CIPD

The CIPD’s guidance covers:

- Encouraging vaccination and how to communicate this

- Adopting a vaccination policy

- Planning for employees who can’t have the vaccine

- Planning for employees who may be hesitant or refuse

- Asking employees (and potential employees) if they have had the vaccine

Where working from home is not possible, in addition to the Government guidance, the CIPD is urging businesses to ensure they can meet three key tests before bringing people back to the workplace; these are:

1. Is it essential?

Can a person’s role only be done from their place of work?

2. Is it sufficiently safe?

Employers have a duty of care to identify and manage risks to ensure the workplace is sufficiently safe to return to

3. Is it mutually agreed?

There must be conversations between employers and employees, so individual worries are taken into account and adjustments can be made

In other exciting news…

We have some new additions to the Affinity HRM team!

I am so pleased to welcome 2 new associates to our HR family. Please join me in giving them a very warm welcome!

Arti Govind

Arti will join me on the advisory side of the business as a HR Consultant. She brings 15 years of diverse HR experience with her, having worked for Marks & Spencer, Costa, Marriott, Leicestershire Police, and most recently the NHS.

Emily Laflin

Emily will be supporting us with all aspects of our HR and business administration. As a qualified HR professional and an experienced recruiter, she brings an extensive and valuable skill-set to the team.

Final Word

We hope this update helps you to prepare for the upcoming changes in the new financial year and allows you to stay one step ahead of any employment developments that may affect how your business operates.

From furlough announcements to employment law changes, with our support, you can make sense of your obligations, adapt with minimal fuss, and prevent costly mistakes.

With our fixed-fee HR service we’ll help you review and update your documentation, ensuring your compliance, whilst saving you valuable time.

If you have any questions about anything in this article or any additional HR topic, then please don’t hesitate to get in touch via email – aleena@affinityhrm.co.uk – or by phone – 0116 478 0025.

The last year has been a challenging, yet exciting time for HR and we can’t wait to see what the rest of 2021 has in store!

I’d like to take this opportunity to say a huge thank you to absolutely every one of you who has helped keep us busy throughout the pandemic; stay safe!

(*This update is a general summary of the current guidance in England and is up to date at the time of publishing. It should not replace advice tailored to your specific circumstances.)